CRSH Dividend History: Investing in stocks can feel like navigating a maze. With countless options and variables, finding the right investment requires careful consideration. One stock that has recently caught the eye of investors is CRSH. Known for its robust performance and reliable dividends, CRSH stands out in an ever-competitive market. Understanding its dividend history isn’t just about numbers; it’s about assessing potential growth and stability for your portfolio. Let’s dive into what makes CRSH a compelling choice for both seasoned investors and newcomers alike as we explore its journey through the world of dividends and stock performance.

What is a dividend?

A dividend is a portion of a company’s earnings distributed to its shareholders. It represents a reward for investing in that company, reflecting its profitability and commitment to returning value.

Companies typically pay dividends every quarter, but some may choose annual or semi-annual distributions. The amount can vary based on the company’s performance and decision-making processes.

Dividends come in various forms, including cash payments or additional shares of stock. Many investors seek these payouts as a form of income, especially those looking for steady returns during uncertain market conditions.

The frequency and size of dividends can be influenced by several factors, such as overall business health, market competition, and growth opportunities. Understanding how dividends work helps investors make informed decisions about their portfolios.

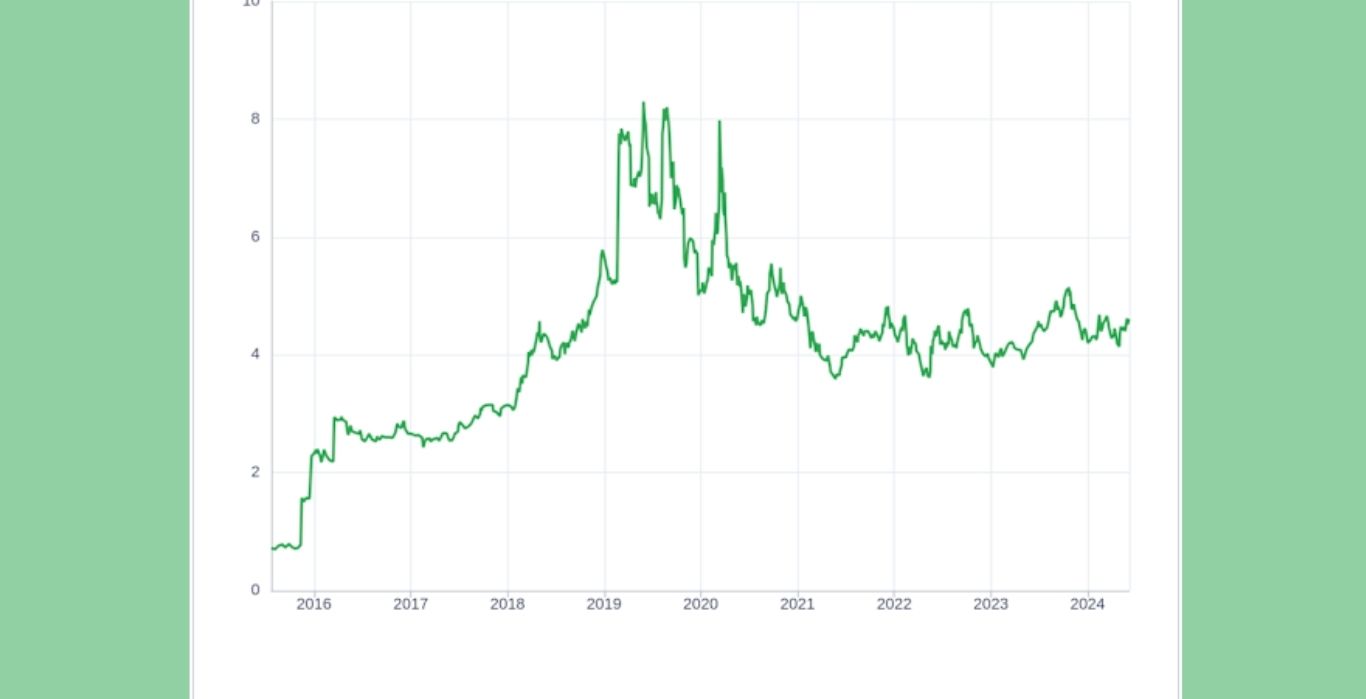

CRSH dividend history and growth

CRSH has established a noteworthy track record in its dividend history. Investors have seen consistent dividends, reflecting the company’s commitment to returning value to shareholders.

Since initiating its dividend program, CRSH has marked steady growth year after year. The annual increases demonstrate not just profitability but also a strategic focus on rewarding investors.

The company’s robust financial health plays a crucial role in sustaining this growth trajectory. Strong cash flows and prudent management decisions ensure that the dividends remain stable and predictable.

Additionally, CRSH’s approach of reinvesting profits wisely contributes to enhancing shareholder confidence. This creates an appealing narrative for both current and prospective investors looking at long-term gains alongside regular income from dividends.

Factors influencing CRSH stock performance

CRSH stock performance is influenced by various factors that investors should consider. Market sentiment plays a key role. Positive news about the company can drive prices up, while negative reports may lead to declines.

Economic indicators also impact stock movements. Changes in interest rates or inflation can shift investor focus away from equities like CRSH towards safer investments.

Company-specific developments are crucial too. Earnings reports, management changes, and product launches often cause fluctuations in stock price.

Additionally, industry trends shape how CRSH performs relative to its peers. A surge in demand for innovative solutions could bolster confidence and attract more investors.

Geopolitical events cannot be overlooked. Trade policies or international relations may create uncertainty that affects overall market conditions and specific stocks like CRSH.

Comparison of CRSH to industry peers

CRSH has carved a niche in its industry, but how does it stack up against its peers? A comparative analysis reveals interesting insights.

When assessing CRSH’s dividend yield, it’s essential to note that several competitors offer higher yields. However, CRSH maintains a robust payout ratio and demonstrates consistent growth in dividends. This stability is often more appealing than short-term gains for long-term investors.

Looking at stock performance metrics like price-to-earnings ratios and market capitalization can further shed light on where CRSH stands. While some industry rivals boast lower P/E ratios, indicating potential undervaluation, CRSH shows resilience through steady earnings growth.

Market sentiment plays a significant role as well. Industry trends can impact all players; however, CRSH’s strategic initiatives position it favorably against others navigating similar challenges.

Future outlook for CRSH stock

The future outlook for CRSH stock appears promising. Analysts predict a steady growth trajectory, driven by expanding market opportunities.

Several factors contribute to this optimism. The company has demonstrated resilience in navigating economic fluctuations. Its commitment to innovation can enhance its competitive edge and attract new investors.

Moreover, strategic partnerships are likely to play a pivotal role in CRSH’s expansion plans. Collaborations with industry leaders may open doors to untapped markets and diversify revenue streams.

Investor sentiment is also shifting positively as dividends have shown consistent growth over recent quarters. This trend often signals financial stability, encouraging more long-term investments.

However, vigilance is necessary as external market conditions can impact performance. Keeping an eye on interest rates and global events will be crucial for potential investors looking at CRSH stock moving forward.

Conclusion and investment recommendations

Investing in CRSH stock comes with its own set of opportunities and challenges. The company’s consistent dividend payments demonstrate a strong commitment to returning value to shareholders, which can be appealing for income-focused investors.

When evaluating the potential for future growth, consider the historical trend of CRSH’s dividends. A steady increase may indicate financial stability and management’s confidence in ongoing performance. Additionally, understanding market forces that affect CRSH stock is essential; fluctuations in the industry or economic shifts can play a significant role.

Comparing CRSH with its peers offers further insights into how it stands within its sector. While some competitors may provide higher yields, others might boast more robust growth prospects—an important factor for any investor’s strategy.

Looking ahead, keeping an eye on both macroeconomic indicators and company-specific developments will help inform your investment decisions regarding CRSH. Whether seeking short-term gains or long-term stability through dividends, it’s crucial to align your investment approach with your personal financial goals.

For those considering adding CRSH to their portfolio, thorough research combined with awareness of industry trends will lead to informed choices down the line.

Leave a comment