Introduction to Gomyfinance

Managing your finances can feel overwhelming. Between budgeting, saving, investing, and planning for the future, it’s easy to get lost in the complexity of personal finance. That’s where smart financial planning tools like Gomyfinance come into play.

Whether you’re just starting your financial journey or looking to optimize your existing strategy, having the right platform can make all the difference. Gomyfinance offers a comprehensive approach to money management that simplifies complex financial decisions and helps you build lasting wealth.

In this guide, we’ll explore how Gomyfinance revolutionizes financial planning and why it might be the solution you’ve been searching for to achieve your money goals.

What Makes Gomyfinance Different?

Traditional financial planning often involves juggling multiple apps, spreadsheets, and advisors. Gomyfinance streamlines this process by bringing everything under one roof. The platform combines budgeting tools, investment tracking, and financial goal setting into a single, user-friendly interface.

The key differentiator lies in its intelligent automation. Rather than requiring manual data entry for every transaction, Gomyfinance connects directly to your bank accounts and credit cards, automatically categorizing expenses and tracking your spending patterns. This real-time visibility into your finances eliminates guesswork and provides accurate insights into your financial health.

Core Features That Drive Results

Automated Budget Creation

Creating a budget shouldn’t take hours of manual calculation. Gomyfinance analyzes your spending history and income patterns to generate a personalized budget automatically. The system identifies your essential expenses, discretionary spending, and savings potential, then creates realistic budget categories that align with your lifestyle.

The platform also adjusts your budget dynamically as your circumstances change. Got a raise? Gomyfinance will suggest optimal ways to allocate the additional income between savings, investments, and lifestyle improvements.

Investment Portfolio Management

Building wealth requires more than just saving money—you need your money working for you through smart investments. Gomyfinance provides portfolio management tools that help both beginners and experienced investors make informed decisions.

The platform offers risk assessment questionnaires to determine your investment personality, then suggests diversified portfolio options that match your risk tolerance and time horizon. You can track performance across all your investment accounts, from 401(k) plans to individual brokerage accounts, giving you a complete picture of your wealth-building progress.

Goal-Based Financial Planning

Gomyfinance transforms abstract financial goals into concrete, actionable plans. Whether you’re saving for a house down payment, planning for retirement, or building an emergency fund, the platform breaks down large goals into manageable monthly targets.

Each goal comes with a personalized timeline and savings recommendations. The system shows you exactly how much you need to save each month to reach your target date, and it adjusts automatically if you fall behind or get ahead of schedule.

How Gomyfinance Simplifies Complex Decisions

Financial planning involves countless decisions, from choosing the right savings account to determining optimal retirement contributions. Gomyfinance uses data-driven insights to simplify these choices.

The platform’s recommendation engine analyzes your financial situation and suggests specific actions to improve your financial health. This might include refinancing high-interest debt, increasing your emergency fund, or adjusting your investment allocation based on market conditions.

Debt Management Strategies

High-interest debt can derail even the best financial plans. Gomyfinance tackles this challenge by creating personalized debt payoff strategies. The platform compares different approaches—such as the debt snowball versus avalanche methods—and shows you the long-term impact of each strategy on your overall financial picture.

You’ll see exactly how much interest you’ll save by paying off certain debts first, and the system motivates by tracking your progress and celebrating milestones along the way.

Tax Optimization Tools

Tax planning shouldn’t be an afterthought. Gomyfinance integrates tax considerations into your overall financial strategy, suggesting opportunities to minimize your tax burden through strategic contributions to retirement accounts, tax-loss harvesting, and timing of major financial decisions.

Getting Started with Gomyfinance

Setting up your financial plan with Gomyfinance is straightforward. The onboarding process begins with a comprehensive financial assessment that captures your current assets, liabilities, income, and expenses. This initial snapshot forms the foundation for all future recommendations.

The platform guides you through connecting your financial accounts securely, using bank-level encryption to protect your sensitive information. Once connected, Gomyfinance begins analyzing your financial patterns and generating personalized insights within 24 hours.

Customizing Your Financial Strategy

Every person’s financial situation is unique, and Gomyfinance recognizes this reality. The platform allows extensive customization of your financial plan, from adjusting budget categories to modifying investment allocations based on your preferences.

You can set multiple financial goals with different priorities and timelines. The system balances competing objectives—such as saving for retirement while also building a house fund—and provides clear guidance on how to allocate your resources effectively.

Monitoring Progress and Staying on Track

Financial planning isn’t a set-it-and-forget-it activity. Gomyfinance provides ongoing monitoring and adjustment capabilities to keep your plan aligned with your changing life circumstances.

The platform sends personalized notifications when you’re approaching budget limits, when investment rebalancing is recommended, or when opportunities arise to optimize your financial strategy. These proactive alerts help you stay engaged with your finances without feeling overwhelmed by constant monitoring.

Performance Tracking and Analytics

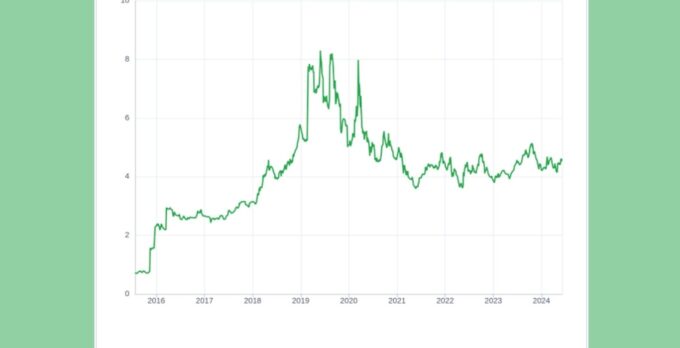

Understanding your financial progress requires clear metrics and visualizations. Gomyfinance provides comprehensive dashboards that track your net worth growth, investment performance, debt reduction progress, and goal achievement rates.

The analytics go beyond simple charts to provide actionable insights. You’ll understand which spending categories are trending up or down, how your investment returns compare to market benchmarks, and whether you’re on track to meet your long-term financial objectives.

Security and Privacy Considerations

When choosing a financial planning platform, security should be a top priority. Gomyfinance implements enterprise-grade security measures to protect your financial data, including multi-factor authentication, data encryption, and regular security audits.

The platform operates under strict privacy policies that prevent your financial information from being sold to third parties. Your data is used solely to provide personalized financial planning services and improve the platform’s functionality.

Transform Your Financial Future

Smart financial planning isn’t about perfection—it’s about progress. Gomyfinance provides the tools, insights, and guidance needed to make consistent progress toward your financial goals, regardless of where you’re starting from.

The platform’s combination of automation, personalization, and comprehensive features makes sophisticated financial planning accessible to everyone. By consolidating your financial life into one intelligent platform, you can spend less time worrying about money and more time enjoying the financial security you’re building.

Ready to take control of your financial future? Gomyfinance offers a smart, comprehensive approach to financial planning that can help turn your money goals into reality.

Leave a comment