Introduction to Define Cash Management Services

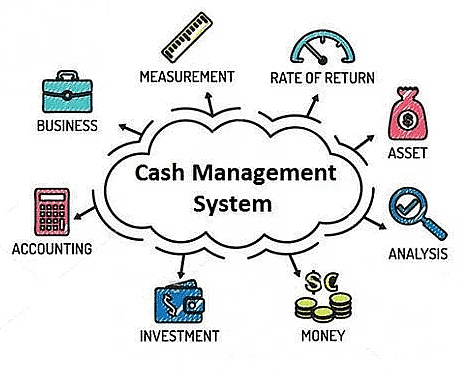

Cash flow is the lifeblood of any business. Yet, managing that cash flow effectively can feel like navigating a complex maze. This is where define cash management services come into play. But what exactly are they? Defined as a suite of financial tools and strategies designed to optimize an organization’s liquidity, these services help businesses ensure they have enough capital on hand for day-to-day operations while maximizing returns on excess funds.

Understanding how to define cash management services opens up a world of possibilities for companies looking to enhance their financial health. Whether you’re a small startup or an established enterprise, mastering your cash flow isn’t just beneficial; it’s essential for long-term success. Let’s dive deeper into why effective cash management matters and how you can leverage these services to propel your business forward.

Understanding the importance of cash management for businesses

Cash management is a crucial aspect of running any business. It goes beyond simply tracking income and expenses. Effective cash management ensures that a company has enough liquidity to meet its obligations.

Businesses face numerous challenges related to cash flow, including delayed customer payments and unexpected expenses. Without proper management, these issues can lead to financial strain or even insolvency.

Understanding cash flow cycles enables businesses to plan for their future needs. This knowledge allows them to optimize their resources efficiently.

Additionally, strong cash management practices facilitate better investment opportunities. Companies can reinvest surplus funds or take advantage of market trends when they’re financially stable.

Prioritizing effective cash management leads to more informed decision-making and strategic growth potential in an ever-changing marketplace.

The different types of cash management services available

define cash management services come in various forms to meet the diverse needs of businesses. One common type is liquidity management, which helps companies maintain optimal cash flow by balancing incoming and outgoing funds.

Another service is payment processing, where providers facilitate efficient transactions through electronic means. This ensures timely payments to suppliers and improves overall financial operations.

Then there’s reconciliation services. These assist businesses in matching their records with bank statements, identifying discrepancies quickly and accurately.

Investing excess cash can also be a vital part of cash management strategies. Services that offer investment options help businesses generate returns on idle funds while maintaining easy access when needed.

Treasury services provide comprehensive solutions for larger organizations, including risk assessment tools and debt management assistance. Each type plays a crucial role in enhancing operational efficiency and promoting growth within an organization.

Benefits of using cash management services

define cash management services offer a range of advantages that can significantly enhance a business’s financial health. One of the primary benefits is improved cash flow visibility. Businesses gain real-time insights into their cash positions, allowing for informed decision-making.

Additionally, these services help in optimizing liquidity. By efficiently managing incoming and outgoing funds, companies can ensure they have enough resources to meet short-term obligations while maximizing returns on excess cash.

Cost reduction is another key advantage. Automated processes minimize manual errors and administrative costs associated with handling finances traditionally.

Furthermore, risk management becomes easier with structured cash management strategies. Businesses can better anticipate fluctuations in revenue and expenses, leading to more effective budgeting practices.

Partnering with experienced providers allows businesses access to advanced tools and technologies designed specifically for efficient cash oversight. This not only streamlines operations but also fosters growth opportunities through strategic planning.

How to choose the right cash management service provider

Choosing the right cash management service provider is crucial for your business’s financial health. Start by assessing your specific needs. Identify what services you require, such as liquidity management, payment processing, or fraud protection.

Next, research potential providers thoroughly. Look for companies with a strong reputation and positive client feedback. This step ensures that you partner with a reliable organization.

Consider technology and integration capabilities, too. A good provider should offer user-friendly platforms that seamlessly integrate with your existing systems.

Evaluate customer support options as well. Responsive service can make a significant difference in case of issues or inquiries.

Compare pricing structures from different providers. Make sure you’re getting value without compromising on essential features that cater to your unique requirements.

Case studies: Success stories from businesses using cash management services

A local retail chain in Austin adopted define cash management services to streamline its daily operations. By implementing automated cash counting and reconciliation, they reduced errors significantly. This enabled staff to focus more on customer service rather than manual tasks.

In another example, a tech startup leveraged cash flow forecasting tools offered by its provider. This gave them insight into future financial needs, helping them make informed decisions about hiring and product development.

Meanwhile, an established manufacturing company benefited from improved liquidity through effective receivables management. They were able to optimize cash reserves for investments in new machinery.

These stories highlight how diverse businesses have enhanced efficiency and profitability using tailored cash management solutions. Each case demonstrates that understanding your unique needs is crucial when selecting the right services for success.

Conclusion and recommendations for businesses considering cash management services

define cash management services are a crucial component for any business aiming to optimize its financial operations. They provide the tools and strategies necessary to manage cash flow effectively, ensuring that funds are available when needed while minimizing excess liquidity.

For businesses considering these services, it’s essential to assess individual needs and objectives carefully. Start by evaluating the types of cash management solutions offered—like collections, disbursements, or fraud protection—and determine which align with your specific requirements.

Choosing the right service provider is equally important. Look for reputable institutions known for their reliability and customer support. Don’t hesitate to ask about customization options that can fit your company’s unique processes.

Consider looking into case studies from similar organizations that have benefited from these services. Success stories often highlight innovative approaches and practical results, providing insights you might find valuable in making your decision.

Investing time in understanding how define cash management services work will pay off significantly in maintaining financial health and supporting growth initiatives within your business.

Leave a comment